Risk management process

To prevent risks or mitigate their effects and loss, Axfood works with an established enterprise risk management process, where risks are continuously identified, managed and reported. All risks are assessed based on likelihood and consequence. Operational and strategic risks include sustainability risks.

Risk management process

Risks are assessed and documented by the respective risk owners at least twice a year as well as on a continuing basis where necessary. The risk owners are the members of the Executive Committee, who are responsible for the risk maps in their respective areas. An assessment is made of the changed level of existing risks as well as of potential new risks. Strategic risks related to, for example, increased competition, changes in the

assortment and other changes in the external business environment that can affect Axfood’s strategic targets, are managed as part of the continuing work of the Board of Directors and Executive Committee.

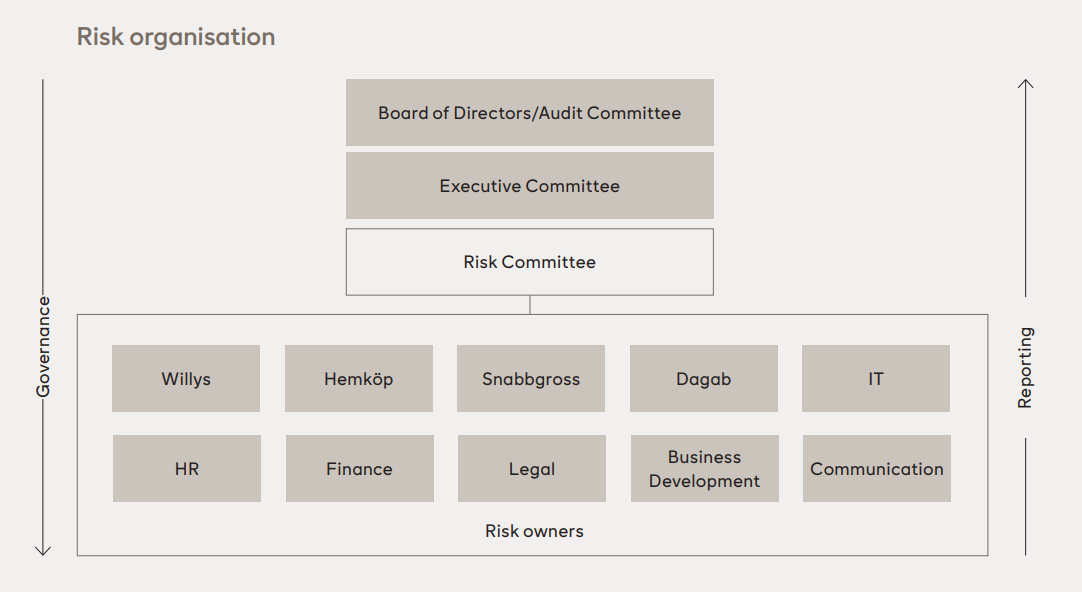

Risks are classified and categorised according to how well countermeasures are implemented. Axfood has a Risk Committee, which is headed by the Group’s Risk Manager. The Risk Committee is tasked with, among other things, following planned countermeasures and consolidating the risks identified by the respective risk owners. A compilation is made centrally and coincides with the timing of the Group’s business plan, which facilitates budgeting for decided countermeasures. For a description of the organisation, governance and reporting of risk management, see the illustration to the right. The acquisition of City Gross was completed on 1 November 2024 and City Gross will be included in the Group’s risk management process from 2025.

Incident management

Incident reporting systems are in place in Axfood. Through these systems, a compilation is made that provides documentation for determining how operational risks are to be prioritised and managed effectively and systematically.

Crisis management and continuity plans

Crisis management plans are in place in Axfood, and practice drills are carried out regularly by all of the Group companies’ crisis management teams. The aim is to ensure preparedness for a crisis and that the right actions are taken at the right time by the designated key functions. The purpose is to minimise acute damage in a situation in which normal procedures are insufficient. For events where there is a risk that a crisis may become drawn-out, active and preventive work is carried out with continuity plans to minimise the duration of any business interruption.

Insurance

Axfood has Group-wide insurance that is reviewed yearly by an independent, external party. The insurances cover, among other things, property, business interruption, product liability, cyberattacks, transports, and director and senior executive liability. All of the Group’s insurance policies are renewed before expiration.