The Swedish food retail market

The food retail industry is an important part of Swedish industry and a large employer, providing livelihood for more than 100,000 people. There are a total of just over 3,000 food retail stores around Sweden. The sector is important for young people, who account for nearly a third of the total number of those employed. In the countryside, grocery stores often serve as a community hub, offering pharmacy services, postal services and package pick-up.

The food retail market is relatively unaffected by economic swings and growth is driven largely by population growth and inflation. Annual market growth has historically been between 2% and 3%. The market is mature, and the three largest players – ICA, Axfood and Coop – together account for approximately 90% of sales. During 2023, Axfood’s market share is estimated to have been about 22% (21).

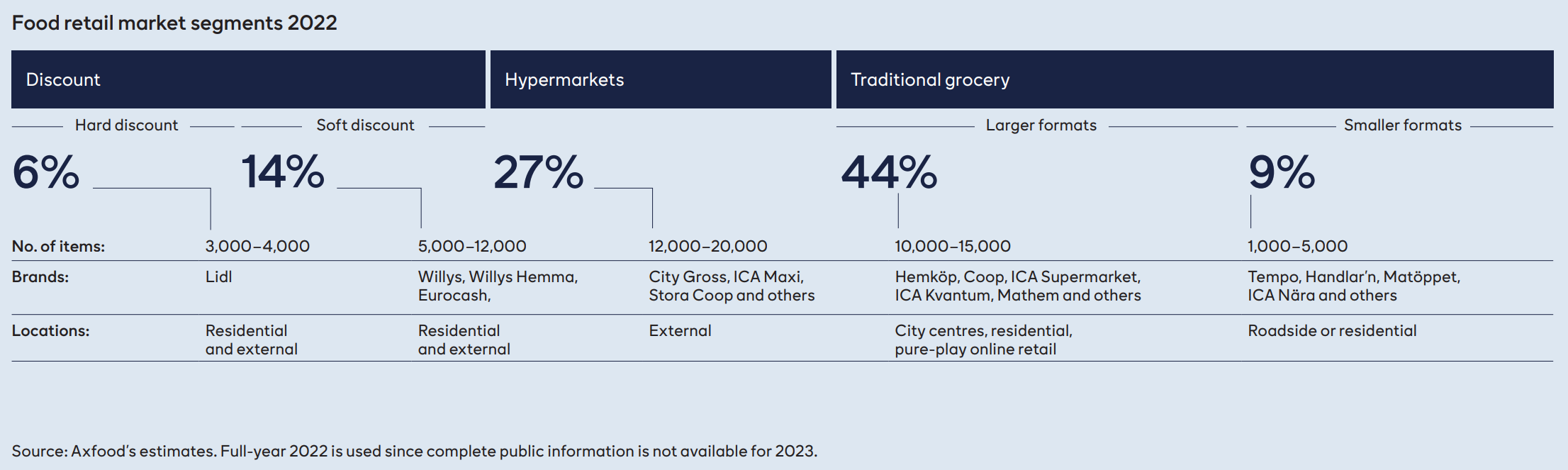

For some time now, growth in food retail has been strongest in the discount segment, where Willys is the leading player. The segment represents just over a fifth of the market and can be divided into two sub-segments, hard discount and soft discount. The biggest difference between the two consists of the offering and breadth of assortment. During the last five years up to 2022, average annual growth for the discount segment is estimated at around 9%, compared with just over 4% for the market as a whole.

Strong trends from the last few year years include an increased share of online shopping within in food retail. This trend accelerated significantly during the pandemic between 2020 and 2021, but the subsequent return to shopping in physical stores is clear. E-commerce still accounts for a small share of the market, around 4.1% in 2023. Sales within e-commerce are relatively evenly distributed between store pick-up and home delivery.

Development during 2023

In 2023, the Swedish food retail market grew by 7.5%, and sales excluding VAT amounted to approximately SEK 290 bn (269). Growth was driven by high food price inflation, which, according to Statistics Sweden, amounted to 12.1% during the year. Market dynamics was characterised by consumers’ price awareness and changing behaviours as a result of the inflation. Growth in e-commerce was negative and amounted to -4.5%.

Sources: Swedish Food Retail Index (Swedish Food Retailers Federation in cooperation with HUI Research) and Axfood’s estimates based on public information.